Although not, an enthusiastic FHA mortgage is generally costly when looking at the latest Apr and other factors on the mortgage

IV. Rates

This new Government Houses Administration makes sure every FHA mortgage loans and you will promises the newest FHA-accepted lender if there is default, and therefore decreases the exposure for the lender whenever issuing the borrowed funds.

The speed towards the an enthusiastic FHA loan or antique home loan try dependent on your credit score and also the size of brand new deposit. Additional factors become market requirements, financing types of (purchase, cash-away refinance), earlier in the day financing fees records, and you can whether or not you opt for a predetermined-price otherwise a variable-rate home loan.

FHA financing rates essentially appear to be more desirable than simply conventional loans with regards to the financing dimensions, deposit, and you will possessions. These include FHA’s upfront and you can yearly mortgage insurance premium (MIP).

V. Home loan Insurance policies (MIP)

Really FHA mortgage loans require fee personal loan on low interest away from a mandatory Initial Home loan Top (UFMIP) and additionally annual Financial Premium (MIP), which takes care of the possibility of default on your own financing. The one-go out step one.75% UFMIP is non recoverable except on a keen FHA Improve Refinance.

A traditional financial need private mortgage insurance (PMI) as long as the brand new down-payment number is actually lower than 20% of your cost. So it insurance policy is designed to include the financial institution should the mortgage standard. PMI pricing derive from your credit score also the loan-to-value (LTV) ratio. PMI is usually paid because the a monthly fee. Although not, you We circumstance where financial will pay the insurance coverage, and you also spend a slightly large rate of interest to cover PMI.

PMI is likely to be more expensive compared to MIP on the a keen FHA mortgage when the credit history is actually low. Yet not, when the credit history is 720 or above, PMI could cost below MIP. This is an essential rates factor, FHA against conventional financing.

VI. Financing Maximum

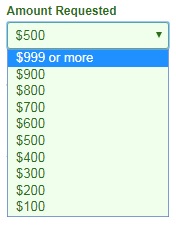

Limitation financing constraints connect with often option, FHA compared to antique mortgage. The brand new Government Property Funds Institution (FHFA) establishes the mortgage constraints on the conforming traditional funds, since FHA set the borrowed funds limitations towards FHA fund situated to the geography. Low-cost section is actually $420,860 and higher costs areas are $970,800.

The fresh FHFA manages Fannie mae and you may Freddie Mac computer which happen to be regulators-paid enterprises. Non-compliant old-fashioned financing which are not backed by Fannie otherwise Freddie (also known as Jumbo fund) don’t have constraints for the loan amount. Compliant antique loans must not surpass $647,2 hundred (2022). In certain areas, this limitation may be high. For example, Fannie and you can Freddie ensure it is an amount borrowed up to $970,800 in some county counties.

VII. Property Standards

That have a keen FHA loan, the home may only be used due to the fact a first home and you may shouldn’t be bought contained in this 3 months of one’s early in the day product sales. Getting conventional financing, the house can be utilized given that a first home, second household, trips family, or money spent.

VIII. Bankruptcy proceeding

Personal bankruptcy cannot automatically disqualify you against sometimes financing style of, FHA against conventional financing. A debtor get qualify for an enthusiastic FHA loan two years once a chapter eight bankruptcy proceeding discharge date. Getting old-fashioned financing, the waiting months try number of years throughout the discharge otherwise dismissal day for a chapter seven personal bankruptcy.

To have Section 13 bankruptcies, hence include a beneficial reorganization of your bills, the brand new prepared period is several years on the dismissal day for a conventional loan.

IX. Refinancing

- What is actually their refinancing objective? If you’re looking getting a money-out refi but have a reduced credit rating, next an FHA refinance could be the most suitable choice.

- What’s your existing home loan? If you actually have an enthusiastic FHA financing, following an enthusiastic FHA Improve Refinance line financing do not require money and you can credit confirmation or an appraisal (susceptible to eligibility requirements).